Throughout your life, you may have to file several different types of insurance claims. you will find that the basic process of filing the claim is similar across most lines of insurance, but that the details vary widely. throughout your li. The ratio of the claims settled will give you a clear idea on the satisfied customers of the company. further to add, the trust of the policyholders in an insurance company is directly related to its claim settlement ratio. death claim settlement ratio 2017-18. death claim settlement ratio as well as claim rejection ratio of various. One ratio that can help you is the claims settlement ratio; this ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. the insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. Claim settlement ratio (csr) is the gauge that clarifies how many claims are settled by the insurance company in a given financial year. it is figured out as the total number of claims received against the total number of claims settled.

Csr is a good indicator of the claim settlement rate of an national insurance company claim settlement ratio insurance company. example: if a company has a claim settlement ratio of 99%. it means that the insurance company has successfully settled 99% of the claims it received. it should give some comfort to you as to how your claim will get handled in the future. Getting homeowners insurance is one of the most important things to do when buying a home. getting the right insurance plan can protect you from floods, storm damage and even vandalism. financial experts say that home insurance is the most. The claim settlement ratio of national insurance company limited is 85. 47%. it means that out of 100 claims raised, the insurer settled 85 of them, which is quite satisfactory. you can check the claim settlement ratio and incurred claim ratios of health insurance companies in 2020 on the website of the insurance regulatory and development. Learn about health insurance claims advertisement by: melissa jeffries every time you go to a new doctor, you do the same thing: fill out long forms with all your insurance information, then give your insurance card to the receptionist. so.

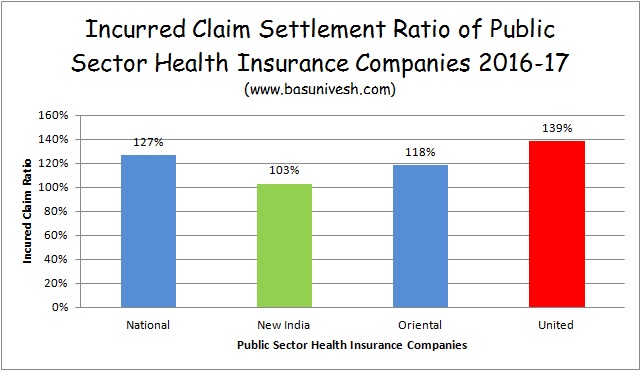

Compare results. find claim settlement in insurance. find claim settlement in insurance. The incurred claim ratio (icr) is the net claims paid by an insurer against the net premium earned. each year, the information on incurred claims ratio of all the companies is published by the insurance regulatory and development authority of india (irdai). the icr of national insurance company ltd. as published for the year 2018-19 is 107. 64%. Car insurance companies in claim settlement ratio currently, there are as many as 25 general insurance companies authorised by the insurance regulatory and development authority of india (irdai). considering the wide array of available car insurance policies, it is often a challenging task to choose national insurance company claim settlement ratio the best car insurance policy.

Latest Health Insurance Claim Settlement Ratio Of Companies

Can An Insurance Company Close My Claim Without Settlement Finance Zacks

When you buy a home with a mortgage, your lender has a security interest in the house. lenders must protect the value of your home just as you would. when your home is damaged by a covered loss, your mortgage company is also a loss payee as. Whether you're in the market for home, life, health or auto insurance, the multitude of companies and its many options can make your head spin. this article will break down the background, history, and insurance offerings of four of the lar. More national insurance company claim settlement ratio images. This ratio tells you that out of 100 claims that the insurance company receives how many have been paid by the insurer. if the claims settlement ratio is 90%, it means that insurer made payments against 90 claims out of 100 claims and did not pay for the remaining 10 claims during the specified period.

A lawyer specializing in insurance bad faith law explains why this happens, and outlines how to fight back. getty images you’d think if you had an all-risk insurance policy, your home or business would be covered for just about anything, ri. The claim settlement ratio of national insurance company limited is 85. 47%. it means that out of 100 claims raised, the insurer settled 85 of them, which is quite satisfactory. you can check the claim settlement ratio and incurred claim ratios of health insurance companies in 2020 on the website of the insurance regulatory and development authority of india (irdai). Find claim settlement in insurance. now with us! search for claim settlement in insurance now!. Search for claim settlement in insurance with us. compare results. find claim settlement in insurance.

The table shows the year-wise claim settlement ratio of all insurance companies. claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. it is calculated as the ratio of total claims settled/total claims incurred. people will prefer an insurer with a higher csr as it gives confidence to people that they are investing in a healthy business and their claims would be remitted in case of any contingency. Claim settlement ratio. claim settlement ratio is the percentage of claims that an insurance company has paid out in a financial year compared to the number of claims received. this percentage is regarded to be a reliable metric for determining if an insurer comes to your rescue when the need arises. it is best to go for an insurer who has a high claim settlement percentage. The national general insurance provides cashless and reimbursement claim settlement procedures. the insurer offers its customers a hassle-free claim process with 78. 52% of claim settlement ratio in fy 2017-18. documents required for making a car insurance claim. original driving licence; car’s registration certificate (rc).

Check Claim Settlement Ratio For Insurance Companies In India

Claim settlement ratio of national insurance can be calculated using the formula given below: claim settlement ratio = (total no. of claims approved/total no. of claims received) x 100. Search for claim settlement in insurance now! search for claim settlement in insurance here. There are many well known insurance companies, such as aflac and state farm. when looking for the right insurance company to suit your needs, you will have to sift through different insurance companies until you find the one with the right.

What does claim settlement ratio (csr) mean? before purchasing a policy, it is important that you check how dependable a health insurance provider is. the claim settlement ratio is a good indicator of the claim support offered by a company. it essentially indicates the number of claims settled by a company out of the total number of claims filed. 92. 25. 1651. 66. 1523. 64. 133. 56. the table shows the year-wise claim settlement ratio of all insurance companies. claim settlement ratio (csr) is the most important factor to access the credibility national insurance company claim settlement ratio of the insurer and its capacity to remit claims. it is calculated as the ratio of total claims settled/total claims incurred. As per the irdai annual report, the claim settlement ratio of hdfc ergo general company insurance ltd. for the year 2018-19 is 76. 36%. let’s look at the insurance claim settlement process. first, provide the insurer with the neft details in the claim form along with a canceled cheque.

High csr indicates that the company has a high claim settling ability. csr is calculated as (total claims settled / total claims filed) multiplied by 100. for instance, a csr of 95% indicates that an insurer has settled 95 claims out of the 100 filed by policyholders. Wondering how long a car insurance claim will take? learn what slows a claim down, and how to file a claim properly to speed it up through the process. thomas j. brock is a cfa and cpa with more than 20 years of experience in various areas.

0 komentar:

Posting Komentar